Solar Equipment Warranty Expense Rates:

It's a bit of an actuarial nightmare. Relatively young companies in new and unproven industries issue very long warranties for which multiple years or even decades can pass before claims arise in volume. But eventually, products mature and claims exceed accruals, and reserves begin to deplete. Then the actuaries break the bad news: it's time to raise rates.

It's almost a sign of maturity. When you launch a new product line in a young industry, one way to impress your customers is to issue extra-long warranties and then fund them generously during the startup phase. And then, as you reach your cruising altitude, you can readjust accruals to reflect actual spending.

In the solar equipment industry, however, what's happening now is that prices are dropping, cutting into sales revenue, and some of the weaker companies are going out of business. Meanwhile, even the startups are getting old enough to see some serious warranty claims build up, and in some cases even exceeding the amounts they've been setting aside in accruals.

This week we're tracking eight solar energy equipment manufacturers, of which three are American, two are Chinese, and one each are Korean, Israeli, and Canadian. We've found that the solar energy equipment manufacturers generally fall into three bands of warranty expense:

- Low -- warranty accrual rates under 1%

- Medium -- warranty accrual rates 1% to 2%

- High -- warranty accrual rates over 2%

In the low expense rate category are Yingli Green Energy Holding Co. Ltd., JA Solar Holdings Co. Ltd., and Canadian Solar Inc. In the medium category are SunPower Corp., First Solar Inc., and Hanwha Q Cells Co. Ltd. And then in the high expense rate category are SolarEdge Technologies Inc. and Enphase Energy Inc.

Industry Veterans

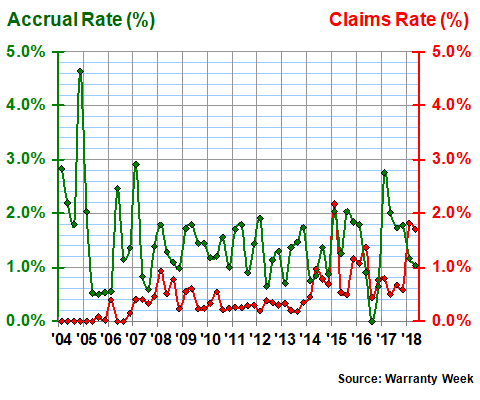

SunPower and First Solar have been reporting their warranty expenses for the longest period, so let's start with them. Each has published 58 quarterly expense reports since the beginning of 2004, providing a rich set of data that illustrates a persistent pattern in the solar industry: accrual rates usually exceed claims rates by a wide margin for a long time, but eventually claims catch up.

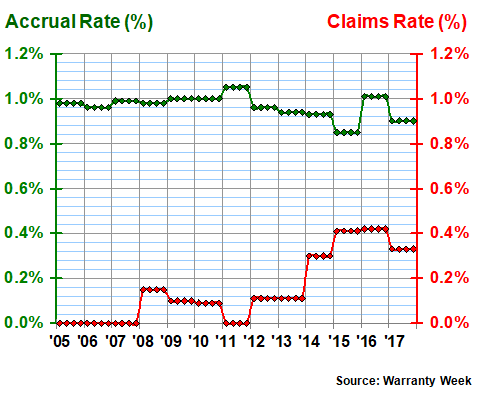

In Figure 1 we see a company whose accrual rate averages 1.4% and whose claims rate was lower than its accrual rate in 51 of the past 58 quarters. However, the claims rate was higher for most of 2016 and has remained higher for the first half of 2018, suggesting that after more than a decade of sales, claims are finally catching up. For instance, while SunPower's claims rate averaged 0.4% from 2004 to 2015, it has been closer to 1.0% in the quarters since then.

Figure 1

SunPower Corp.

Average Claims & Accrual Rates

(as a % of product sales, 2004-2018)

Most of these companies are providing extremely long warranties, some lasting up to 25 years. Some guarantee a given level of electrical output, so if the system degrades below that mark, repairs or replacements are necessary. Therefore, manufacturers set aside accruals 10 or 15 years ago to prepare for expenses that are only now becoming necessary, as the systems age.

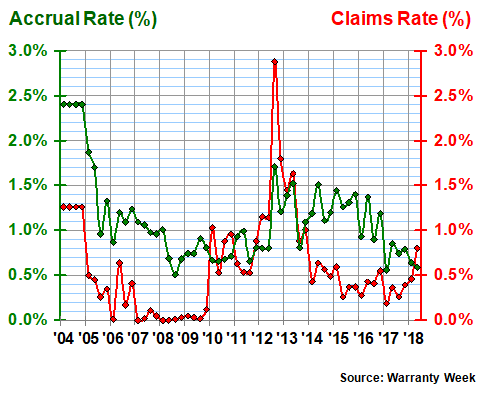

First Solar

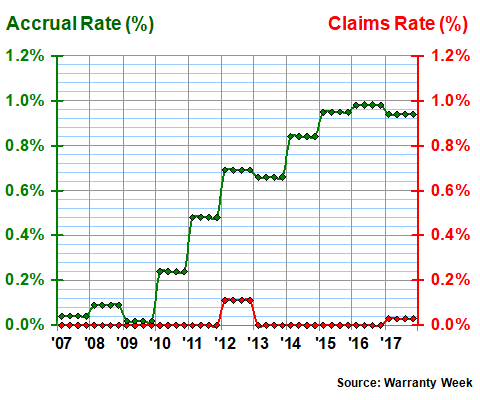

First Solar shows a similar pattern, except its claims rate first caught up to accruals in 2010, and remained high in 2012 and 2013, before falling back again in 2014. However, its claims rate once again exceeded accruals in the second quarter of this year.

Figure 2

First Solar Inc.

Average Claims & Accrual Rates

(as a % of product sales, 2004-2018)

Both of these companies fall into the medium category of warranty expenses. SunPower's long-term average accrual rate is 1.4%, with a relatively high standard deviation of 0.7%, suggesting the high volatility we can see in Figure 1. First Solar's long-term average is 1.9%, with a standard deviation of 0.5%, suggesting almost as much volatility in Figure 2.

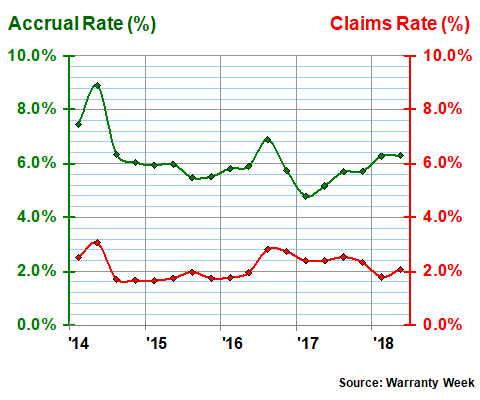

SolarEdge

Thanks to a reader's suggestion, we found an Israeli company reporting its warranty expenses in dollars. SolarEdge Technologies was founded in 2006 near Tel Aviv, and went public in 2015, retroactively providing the 2014 warranty data included in Figure 3 at the time of its initial public offering.

Although there are only 14 quarters of data available, the gap between the company's average claims and accrual rates has remained close to four percent for most of that period, and the lines have so far never crossed. After another decade, let's see if that's still true.

Figure 3

SolarEdge Technologies Inc.

Average Claims & Accrual Rates

(as a % of product sales, 2014-2018)

We should note that SolarEdge, like our next company Enphase Energy, makes a key piece of the solar energy system called the inverter, while SunPower and First Solar make the actual solar panels. While the solar panels gather the sunlight and turn it into electricity, the inverters turn it from direct current electricity into the alternating current electricity that the grid uses. And while individual solar panels can fail and reduce output accordingly, inverters would be a central point of failure that results in system downtime.

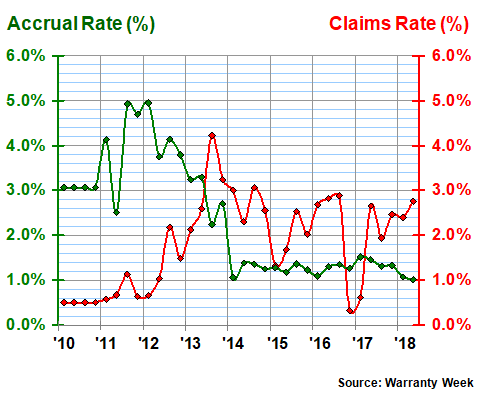

Higher Warranty Expense Rates

Without getting too deep into the intricacies of the systems design and manufacturing methods involved, it is obvious from a comparison of the averages in Figures 1 & 2 versus those in Figures 3 & 4 that the inverters generate more warranty expense than the solar panels. SolarEdge's accrual rate averaged 6.1% with a standard deviation of 0.9%, while Enphase averages 2.3% with a 1.3% standard deviation. So the two companies belong in the high band of this industry's warranty expense rates.

Figure 4

Enphase Energy Inc.

Average Claims & Accrual Rates

(as a % of product sales, 2010-2018)

Note also that Enphase's claims rate exceeded its accrual rate in the middle of 2013, and has remained higher for most of the past five years. In fact, since mid-2013, Enphase's claims rate has averaged 2.4%, a full percentage point higher than its accrual rate. As a result, Enphase is constantly adding extra accruals to its warranty reserves through changes in estimate, which don't show up in Figure 4.

International Manufacturers

Yingli and JA Solar, our two Chinese manufacturers, both report their warranty expenses in yuan, the official currency of the People's Republic. Hanwha and Canadian Solar both report in U.S. dollars. But because our warranty expenses are expressed in percentages rather than in amounts, those considerations drop out of the calculations.

All four international manufacturers, however, detail their warranty expenses only once a year, in their annual reports. So all the percentages in Figures 5 through 8 have been averaged over four quarters, and there is not yet any 2018 data.

Yingli and JA Solar are at the very low end of our three warranty expense bands, with accrual rates at or below one percent. In Figure 5 we can see that Yingli has kept its accrual rate close to one percent while its claims rate rose in recent years, while JA Solar gradually raised its accrual rate to one percent while its claims rate remained close to zero.

Figure 5

Yingli Green Energy

Average Claims & Accrual Rates

(as a % of product sales, 2005-2017)

In no year have either Yingli or JA Solar seen their claims rates exceed their accrual rates. In fact, Yingli reported no claims from 2005 to 2007 and again in 2011. JA Solar has reported claims only in the years 2012 and 2017. And since the company recently took itself private, there is not likely to be a 2018 annual report.

Figure 6

JA Solar Holdings Co. Ltd.

Average Claims & Accrual Rates

(as a % of product sales, 2007-2017)

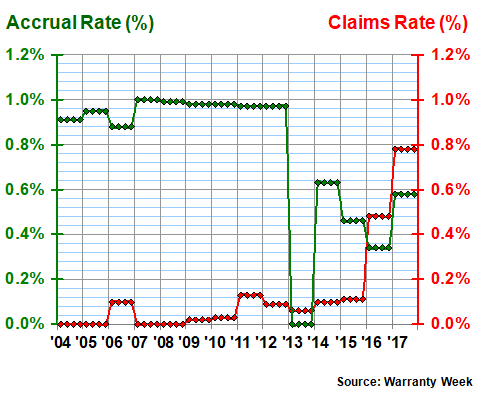

Canadian Solar, based about an hour outside of Toronto in the city of Guelph, is the third member of the low band of our warranty expense rate hierarchy. As can be seen in Figure 7, the company kept its accrual rate close to one percent from 2004 to 2012, but then dropped it abruptly. Meanwhile, its claims rate, which remained very low from 2004 to 2015, has exceeded its accrual rate for each of the past two years.

Figure 7

Canadian Solar Inc.

Average Claims & Accrual Rates

(as a % of product sales, 2004-2017)

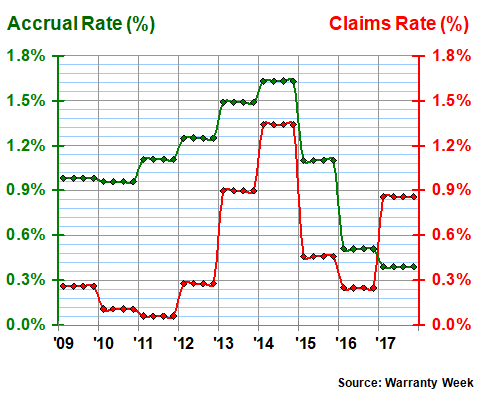

In fact, five of the eight companies we're tracking this week have seen their claims rate recently climb higher than their accrual rates. Hanwha Q Cells is the fifth, as can be seen in Figure 8. From 2009 until 2014, the gap between the two rates narrowed, and then in 2017 they flipped, with accruals falling to their lowest-ever level while claims rose to nearly 0.9% of revenue.

Figure 8

Hanwha Q Cells Co. Ltd.

Average Claims & Accrual Rates

(as a % of product sales, 2009-2017)

Perplexingly, Hanwha has also removed funds from its warranty reserve through changes of estimates during each of the past three years. In 2017, it removed US$7.6 million, even though claims exceeded accruals by US$9.6 million. Now, its warranty reserves are equal to less than three years of claims payments, down from 8 to 10 years in the recent past.

Of course, the big risk with 25-year product warranties is that the company that issues them won't be around long enough to see them all expire peacefully. SunPower and First Solar, the veterans of our group (founded in 1985 and 1990, respectively), are the only two of the eight companies to pass their 25th birthdays so far. Yingli is 21, Hanwha is 19, and the other four are younger. And several companies, which were part of our past-year snapshots of solar industry warranties, are already gone.